|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

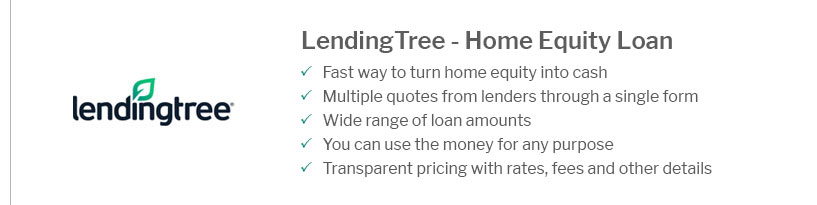

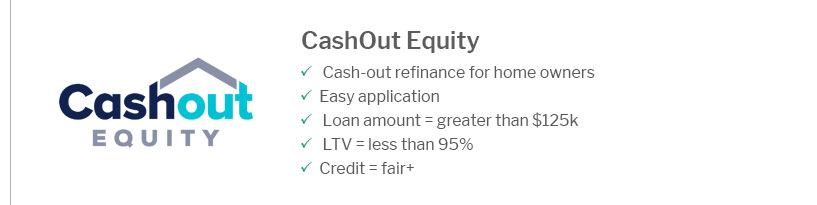

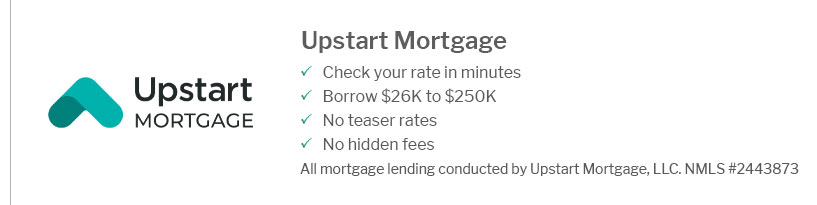

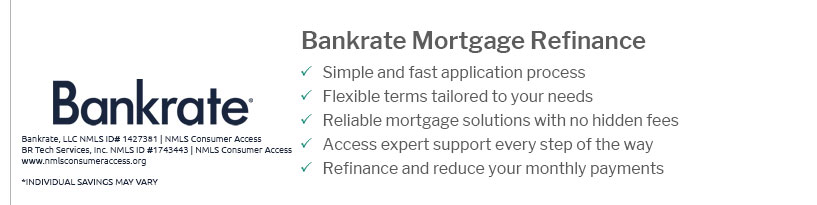

Understanding Good Home Loans: Key Features and HighlightsWhen it comes to purchasing a home, securing a good home loan can make a significant difference in your financial health and peace of mind. It's essential to understand what constitutes a good home loan and how to identify one that suits your needs. Key Features of Good Home LoansGood home loans often have competitive interest rates, flexible terms, and minimal fees. Here are some of the main features you should look for: Competitive Interest RatesA good home loan typically offers a competitive interest rate that reflects the current market trends. This helps in reducing the overall cost of the loan over time. Flexible Repayment TermsFlexibility in repayment terms can greatly benefit borrowers. Look for loans that offer adjustable term lengths or options to make extra payments without penalties. Low Fees and ChargesGood home loans have minimal fees associated with them. Be sure to review any hidden charges that may increase the loan's cost. Exploring mortgage refinance rates michigan can help you find loans with favorable terms and lower interest rates. Benefits of Securing a Good Home Loan

Tips for Finding a Good Home Loan

Consider options that allow you to refinance house without closing costs for even more savings and convenience. FAQ SectionWhat is considered a good interest rate for a home loan?A good interest rate for a home loan is typically one that is below the current market average. It can vary based on the economic climate and your credit profile, but generally, a rate below 4% is considered favorable. How can I negotiate better terms on my home loan?To negotiate better terms on your home loan, improve your credit score, increase your down payment, and compare offers from multiple lenders. You can also use mortgage brokers to help you find competitive offers. Are there any programs to help first-time homebuyers get good loans?Yes, there are several programs such as FHA loans, VA loans, and USDA loans that offer favorable terms and lower down payment requirements for first-time homebuyers. https://ncdoj.gov/protecting-consumers/mortgages-home-loans/

If you're in the market for a home loan, remember to shop around, to compare costs and terms, and to negotiate for the best deal. Here are some details to pay ... https://www.forbes.com/advisor/mortgages/best-mortgage-lenders/

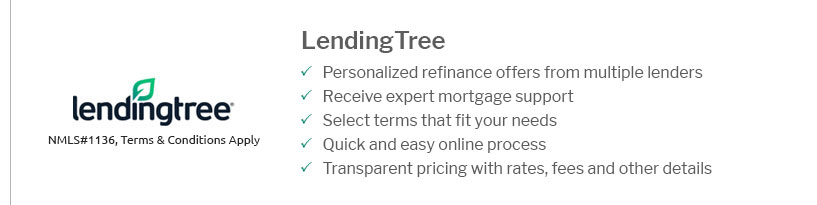

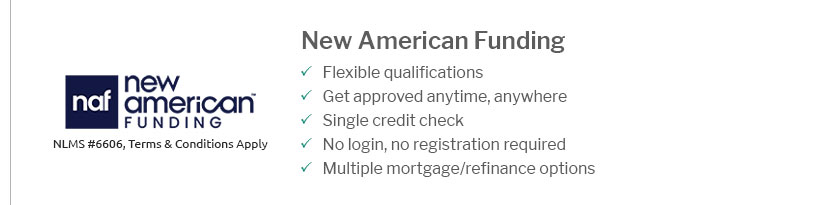

Best Mortgage Lenders Of 2025 ; Best for Low Credit Scores. New American Funding. New American Funding ; Best for Nationwide Availability. Bank of ... https://www.usaa.com/inet/wc/bank-real-estate-mortgage-loans

For first time home buyers, an online course ...

|

|---|